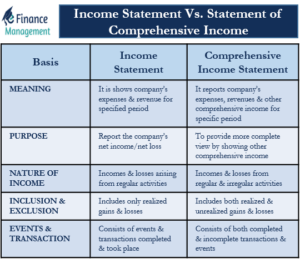

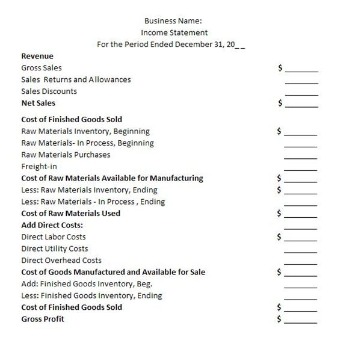

(2) The “multi-step” income statement example breaks out the Gross Profit and Working Revenue as separate lines. It first calculates the Gross Revenue by subtracting Value of Goods Sold from Internet Gross Sales. It calculates the Operating Revenue and then adjusts for interest expense and revenue tax to provide the Earnings from Persevering With Operations. From the perspective of traders and analysts, the inclusion of OCI in comprehensive revenue supplies a more complete image of an organization’s performance and potential future money flows. It allows for a better assessment of risks and returns, particularly for corporations with important worldwide operations or those that invest closely in financial devices.

Basic Annual Report Statement Of Complete Earnings

The amount of curiosity expense showing on the income assertion is the price of the money that was used through the time interval proven within the heading of the income statement, not the quantity of curiosity paid throughout that period of time. If the company receives less than the guide value, the difference is reported as a loss on the company’s earnings statement. If the asset had a guide worth of $15,000 and the corporate obtained $10,000 the corporate will report loss on sale of equipment of $5,000.

Internet Payable Vat Calculation For The Present Tax Period(note-

The “Other Complete Earnings (OCI)” line item is recorded on the shareholders’ fairness section of the steadiness sheet and consists of a company’s unrealized revenues, bills, gains, and losses. While comprehensive earnings supplies priceless insights into all modifications in fairness, it is important to consider the tax implications of the items reported in OCI. Tax legal guidelines range broadly, and the timing of when these things turn into taxable or deductible can considerably impression an entity’s tax technique and financial planning. Understanding these nuances is vital to a complete analysis of an entity’s monetary statements. Working revenue, also recognized as operating revenue or earnings earlier than curiosity and taxes (EBIT), represents the profit from a company’s core business operations. It is calculated by subtracting operating bills, together with the cost of goods bought (COGS), selling, general and administrative expenses (SG&A), depreciation, and amortization, from the whole revenue.

The e-book worth of an asset is the amount of cost in its asset account much less the accumulated depreciation applicable to the asset. The book value of an asset can also be referred to as the carrying worth of the asset. If ABC understood that by spending an additional $1 it may probably earn $7, it may have produced extra loaves. In different words, risking $200 in ingredients to doubtlessly obtain an extra $1,400 could have motivated ABC to supply extra loaves. Wanting at it another means, ABC would get well the extra $200 value for components by selling simply 30 of the 200 extra loaves.

This section explores the method to analyze this assertion, perceive the influence of Comprehensive Income on financial health, and use ratio evaluation and efficiency metrics. Advantages of this method embrace the benefit of seeing the relationship between internet revenue and complete revenue and the comfort of presenting all income-related info in one document. This can enhance the clarity and understanding of the company’s overall monetary performance for stakeholders. It also needs to be noted that for the rationale that property are discontinued, no depreciation is taken on the belongings since they are not actively utilized in producing revenue. Discontinued operations are presented individually on the assertion of income or complete earnings and likewise on the assertion of money flows. When preparing the income statement (or statement of comprehensive income) it’s important to note that discontinued operations amounts should be reported web of tax.

This includes gadgets that have not been realized when it comes to cash circulate, corresponding to unrealized gains or losses on overseas currency translation, and available-for-sale monetary belongings. The tax therapy of this stuff can be complicated, because it often is determined by the jurisdiction and the particular tax legal guidelines relevant to the entity. To illustrate, contemplate a hypothetical know-how firm, Tech Improvements Inc., which reviews a significant portion of its complete earnings from overseas operations.

- Note that the assertion for Toulon Ltd. (shown earlier within the chapter) combines internet earnings and complete comprehensive income.

- The value of gross sales, price of goods sold, or cost of merchandise bought is the company’s cost for the products that it bought during the interval indicated in the income statement’s heading.

- The statements show the earnings per share or the online profit and the way it’s distributed throughout the excellent shares.

- Internet Revenue, often referred to as the “bottom line,” is a extensively known figure representing the revenue or loss a company generates from its operations and other enterprise actions throughout a specific interval.

- The interaction between profit or loss and OCI is unclear, especially the notion of reclassification and when or which OCI objects should be reclassified.

- This allocation course of can be cumbersome and will require more time, effort, and professional judgement.

As noted above, different complete income consists of unrealized income or unrealized positive aspects or losses. (However, interest expense and other nonoperating expenses are not included; they are reported separately.) These expenses are not thought-about to be product costs and are not allocated to objects in stock or to price of goods sold. As A Substitute these bills are reported on the earnings https://www.simple-accounting.org/ assertion of the interval by which they occur.

The Statement of Complete Income is an important factor of financial reporting, enhancing transparency and offering a extra comprehensive evaluation of a company’s financial efficiency and condition. This expanded view helps stakeholders make extra informed choices regarding their investment, lending, or analytical actions related to the company. The multiple-step format with its section subtotals makes efficiency evaluation and ratio calculations such as gross profit margins simpler to complete and makes it easier to evaluate the company’s future earnings potential. As previously stated, internet income is a measure of return on capital and, hence, of efficiency. This signifies that traders and creditors can usually estimate the company’s future earnings and profitability based mostly on an analysis of its previous performance as reported in internet income.

If the dollar strengthens in opposition to the euro, the translated worth of the company’s European belongings will lower, leading to a loss within the OCI. The presentation should clearly distinguish between the elements of web earnings and different comprehensive revenue, offering a subtotal for each part to boost readability. Effectively presenting the Assertion of Comprehensive Income and adhering to the important thing disclosure necessities are very important features of economic reporting.

Comprehensive earnings is a sturdy measure of an organization’s complete earnings, encompassing not solely the normal web income figures but in addition other forms of income that aren’t realized by way of day-to-day operations. This broader perspective on a company’s monetary well being is particularly priceless for buyers who are wanting to perceive the complete spectrum of a company’s efficiency, past what’s captured within the net earnings. It consists of all modifications in equity during a period besides those resulting from investments by house owners and distributions to house owners.

For example, an organization will have a Cash account in which every transaction involving money is recorded. A firm selling merchandise on credit will record these gross sales in a Gross Sales account and in an Accounts Receivable account. Others use the time period to mean the percentage of gross profit dollars divided by internet sales dollars. The basic guidelines and ideas, requirements and detailed rules, plus industry practices that exist for financial reporting. An expense exterior of a company’s primary operating activities of buying for and selling merchandise or providing providers.